- Understanding the Half Kg Walnut Price in Today's Market

- Global Market Dynamics Influencing Walnut Prices

- Technical Advancements in Walnut Processing

- Leading Walnut Suppliers: Comparative Analysis

- Customized Supply Solutions for Diverse Needs

- Real-life Applications and Case Studies

- Future Trends for Walnut in Half Kg Pricing and Supply

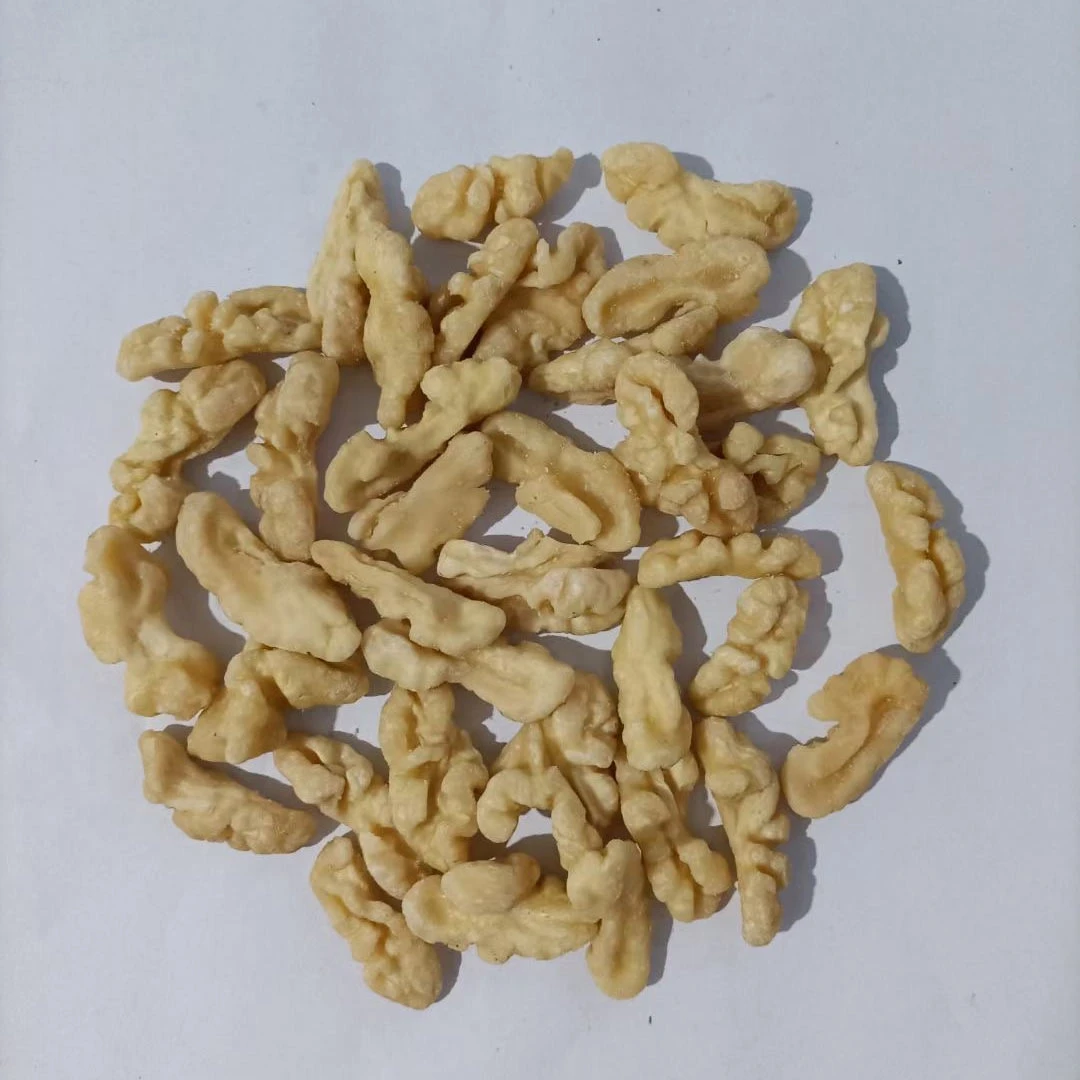

(half kg walnut price)

Understanding the Current Half Kg Walnut Price Landscape

The half kg walnut price

serves as a vital reference for wholesalers, retailers, and end consumers alike. As of Q2 2024, the average retail price for high-quality, shelled halves ranges from $6.80 to $11.50 USD per 500g in North America and Europe, reflecting a sharp contrast to prices in emerging markets such as South Asia, where the cost averages between $4.20 and $8.10 USD per half kilogram. This price band is driven by multiple factors: harvest yields, climatic volatility, processing technology, and global logistics costs. In practical terms, end-users often seek walnuts in half kg lots for both efficiency and freshness, shaping the demand curve across retail and institutional buyers. Changes in international tariffs and the rising trend of healthy snacking have also contributed to a 9% rise in the walnut half kg price over the past 12 months, according to market research firm AgriData Insights.

Price Influencers at a Glance:

- Harvest variability due to climate events

- Rising global demand (up by 13% YoY since 2022)

- Logistics and supply chain disruptions

- Grade and origin of walnuts (US, China, Chile prominence)

Global Market Dynamics Shaping Walnut Pricing

International trade patterns for shelled and in-shell walnuts demonstrate profound variability depending on region and product specification. The United States remains the dominant exporter, commanding over 42% of global supply, but emerging players like Chile and China are rapidly gaining ground. Notably, seasonal price shocks, as seen in the 2023 drought in California, can result in volatility exceeding 18% within a single quarter. For instance, the 2023 Q4 report by the International Nut and Dried Fruit Council noted that the average wholesale price of walnut in half kg packs from California rose by 13% compared to the previous year, while suppliers in Turkey maintained more stable price increments (average 4% YoY over three years) due to advanced irrigation systems.

Key global indicators:

- Currency exchange rates affecting export competitiveness

- Tariff shifts following transcontinental trade agreements

- Value-added packaging (vacuum, resealable) changing retail price dynamics

Technical Innovations in Walnut Processing

The last five years have witnessed major shifts in walnut processing—especially for premium half kg packs—which directly influence both margin and shelf price. Leading innovations include optical color sorters that guarantee up to 98.5% uniformity in shelled halves, and automated de-shelling systems reducing breakage rates below 4%. Moreover, improved post-harvest handling (i.e., nitrogen-flushed packaging) extends shelf life from 6 to 18 months without significant quality loss. These technical advancements result in a more consistent walnut half kg price structure by decreasing waste and improving supply chain efficiency. According to the Walnut Processing Technology Conference 2023, plants incorporating advanced RFID tracking witnessed a 12% decrease in operational costs and an 8% rise in net yields per batch, thereby keeping end-user costs competitive.

| Technology | Cost Reduction (%) | Yield Improvement (%) | Effect on Retail Price (USD/0.5kg) |

|---|---|---|---|

| Color Sorting Automation | 10 | 8 | -0.45 |

| Nitrogen-Flushed Packaging | 7 | 12 | -0.33 |

| RFID Tracking | 12 | 8 | -0.29 |

| Integrated De-shelling | 8 | 11 | -0.38 |

With the adoption of these advancements, suppliers can offer consumers walnuts in half kg sizes at more consistent and attractive price points.

Top Walnut Suppliers: Manufacturer Comparison

When comparing global walnut suppliers, several variables come to the fore: quality certifications, ability to provide consistent half kg packs, traceability systems, and value-added services. Large-scale manufacturers such as Diamond Foods (USA), Borges Agricultural & Industrial Nuts (Spain), and Grower Direct Nut Company (USA) take the lead in terms of scale, technological integration, and international distribution. Meanwhile, niche firms in Turkey and Chile have carved a loyal following by offering custom-graded lots and organic certifications.

| Supplier | Minimum Order (kg) | Certifications | Avg. Half Kg Price (USD) | Traceability | Lead Time (days) |

|---|---|---|---|---|---|

| Diamond Foods (USA) | 50 | USDA, BRC, Kosher | 9.10 | Full Chain RFID | 14 |

| Borges Nuts (Spain) | 30 | IFS, ISO 22000, Organic | 8.80 | QR Batch Coding | 16 |

| Grower Direct Nut Co. (USA) | 25 | GFSI, Gluten-Free | 9.25 | Online Tracking | 10 |

| Anatolia Organic Walnuts (Turkey) | 10 | EU Organic, Halal | 9.45 | Manual Lot Code | 19 |

These data highlight how sourcing the best half kg walnut price requires balancing cost, certification, responsiveness, and logistical efficiency.

Tailored Supply Chains: Customization for Every Client

Buyers in institutional catering, food production, and retail require flexibility in walnut in half kg formats. The rise of B2B walnut marketplaces over the past three years has increased the availability of customized solutions, including private-labeling, bespoke grading, and split-pallet shipments for diversified product portfolios. For example, premium chocolate manufacturers often require halves with minimal breakage (<5%), specific oil-moisture ratios, and eco-packaging for direct retail resale. In the latest survey by FoodChain Logistics, 77% of institutional buyers value just-in-time delivery versus 23% opting for bulk seasonal pre-orders to lock in walnut half kg price stability amid global fluctuations.

- Contractual price guarantees for 3-12 month supply cycles

- Custom protective packaging (biodegradable, vacuum-sealed)

- Batch-specific testing for aflatoxins and moisture content

- Digital order tracking and predictive replenishment options

Customization empowers clients to achieve transparency, comply with export/import regulations, and respond quickly to end-consumer preferences, raising the bar for the walnut supply sector.

Real-World Uses and Impact: Case Studies

The versatility of walnuts in half kg units has been proven across various commercial and consumer scenarios. In the ready-to-eat snack segment, a leading German supermarket switched to pre-packed half kg bags and reported a 21% increase in annual sales, largely driven by improved portion control and perceived freshness. Meanwhile, an Australian confectionery chain reduced ingredient wastage by 16% after integrating a just-in-time procurement model for shelled walnuts sold in half kg lots. An Indian bakery chain achieved 11% higher customer satisfaction scores post-transition to vacuum-packed walnut half kg price contracts, enabled by supplier-side AI predictive analytics for batch quality control.

- Food Manufacturers: Reliable supply of high-grade walnut halves in precisely measured units reduces batch variability and quality complaints.

- Retail Chains: Clear on-pack origin and safe best-by dates increase buyer trust.

- Direct-to-Consumer Brands: Subscription-based delivery models, featuring walnuts in half kg, foster greater engagement and repeat business—CTR uplift of 18% YoY for DTC snack companies, according to Walnut Insights Quarterly 2024.

Collectively, these applications underscore the operational and reputational advantages conferred by sourcing quality half kg walnut lots from reputable, technically advanced suppliers.

Future Prospects: Walnut in Half Kg Price & Supply Trends

Looking ahead, the half kg walnut price is expected to remain relatively firm through 2025, supported by stable demand in health-conscious consumer segments and sustained export growth to Asia-Pacific markets. Factors such as automation in shelling and sorting, expanding organic certifications, and continued currency uncertainty will shape short-to-mid-term market movements. For manufacturers, the push toward biodegradable packaging and carbon-neutral processing will incrementally affect overheads, possibly tempering downward pressure on walnut half kg price. Buyers and brands positioning for next-generation supply chains should focus on traceable sourcing, supply chain resilience, and data-informed procurement models to remain competitive as the walnut market becomes more interconnected, tech-driven, and sustainability-focused.

The walnut in half kg segment stands at the intersection of consumer convenience, technical excellence, and market innovation—setting the stage for ongoing price optimization and value creation for years to come.

(half kg walnut price)

FAQS on half kg walnut price

Q: What is the current half kg walnut price?

A: The average price for half kg walnuts ranges from $4 to $8 depending on quality and region. Prices may change with market fluctuations.Q: Does the walnut half kg price differ by type?

A: Yes, prices for half kg walnuts can vary between shelled and unshelled types. Premium varieties often cost more.Q: Where can I find the best walnut in half kg packs?

A: Many supermarkets and online stores offer half kg walnut packs. Look for trusted brands and check customer reviews.Q: Are there discounts available for half kg walnut price online?

A: Many online retailers provide discounts and seasonal offers on half kg walnut prices. Check for deals before purchasing.Q: How does the quality affect the walnut half kg price?

A: Higher quality walnuts typically command a higher half kg price. Freshness and origin also influence the cost.Post time:Jul . 07, 2025 09:31